In March 2018 GSN acquired the gold rights for the Mon Ami Project which comprises a Mining Lease M38/1256 granted in 2012 for a term of 21 years. The tenement lies within the Mt Margaret Mineral Field of the north-eastern Goldfields of Western Australia (Laverton Greenstone Belt), approximately 14 km east of the Granny Smith Mill and 12 km southeast of Laverton. The ground has widespread gold anomalism, artisanal-scale gold workings.

The Laverton region has a well-documented gold endowment with in excess of 25 million ounces with two world class deposits, in Sunrise Dam and Wallaby, and numerous deposits that show endowment more than one million ounces (e.g. Mt Morgans, Lancefield, Granny Smith).

Encouraging gold mineralisation was identified at Mon Ami in RC drilling undertaken by Valleybrook Investments in late 2017. In June-July 2018, GSN completed a maiden drilling program at Mon Ami comprising 5,821 drill meters from 40 RC drill holes (MLRC011 to 050) designed to test the continuity of that gold mineralisation. Significant intercepts from the drilling were reported in an ASX release dated 16 July 2018.

At the completion of the maiden drilling program the Company commenced resource assessment and the project has now reported, in accordance with JORC (2012), a Resource of 1.56 Mt @ 1.11 g/t Au for 55.5 Koz. The Resource Estimate was released to the market on the 21 July 2021 and has been estimated above a 0.5 g/t gold cut-off.

Metallurgical testwork notes that conventional processing flowsheet, under standard processing conditions, is suitable for treating the Mon Ami gold project ore and produced recoveries averaging 95% in the oxide and transitional mineralisation. This mineralisation would be suited to treatment through a standalone CIL/CIP gold operation or toll treated through one of the existing regional mills. The results relating to the metallurgical testwork were released to the market on 24 January 2019.

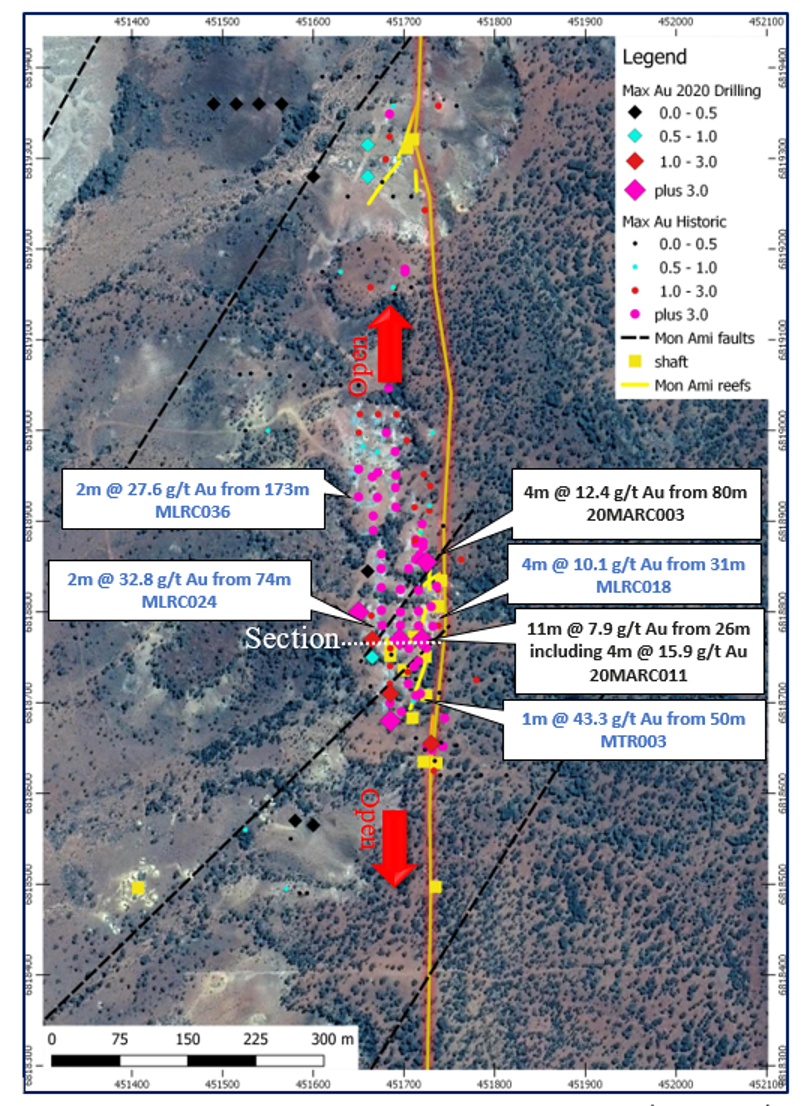

A 20-hole RC program undertaken in 2020 noted a number of high grade, shallow intercepts including 11m @ 7.9 g/t gold from 26m including 4m @ 15.9 g/t gold.

in early 2021 two deeper RC holes (21MARC009 and 10) were designed to test for depth extensions of the main lode at Mon Ami. The target gold mineralisation is considered analogous to the 176koz (at 22.8g/t Au) Ida H underground gold mine, located 8km to the north of Mon Ami along the same Bandicoat shear zone.

Both holes intersected gold mineralisation within a broad zone of chlorite-sericite alteration. Gold is concentrated within quartz veining at the lithological contact of a metasedimentary sequence and a basalt unit within the regional scale Bandicoat Shear Zone.

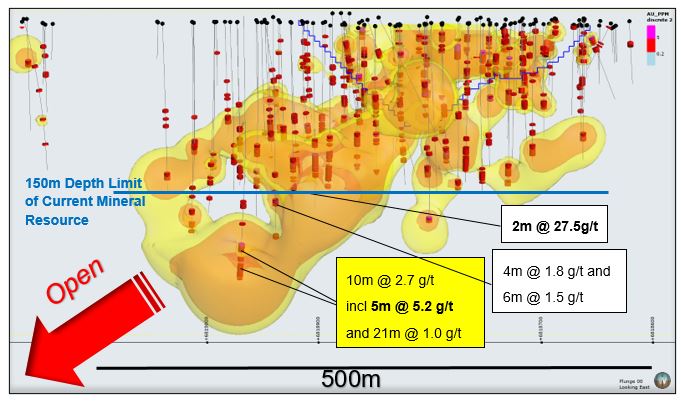

The long section of the Mon Ami deposit (Figure 1) highlights the dominant northerly plunge to the high-grade mineralisation, which this drilling aimed to extend. Both holes intersected significant mineralisation and 21MARC010 was extended 30m past planned hole depth as chlorite-sericite alteration and quartz veining was pervasive. Extension of hole 21MARC010 resulted in a standout wide zone of mineralisation of 10m @ 2.7 g/t Au from 241m including 5m @ 5.2 g/t Au and 21m @ 1.0 g/t Au from 255m.

21MARC010 was a significant 100m step out, down plunge from previously identified high-grade mineralisation in MLRC036 (2m @ 27.5 g/t Au). The high-grade gold mineralisation at Mon Ami is now known to extend for at least 500m and is open along strike and at depth.

This hole is regarded as highly significant as it is the deepest hole drilled to date at Mon Ami, with alteration and mineralisation widening at this location. The high-grade gold mineralisation intersected in hole 21MARC010 is at 210m below the surface, 60m deeper than the current Inferred Mineral Resource of 1.56Mt at 1.11g/t Au for 55,500 ounces of gold (refer ASX announcement 21 July 2021), which is limited to 150m below surface. Mineralisation is currently constrained only by drilling and demonstrates the potential for mineralisation to persist further down plunge along strike.