GSN’s shares the Duketon Greenstone Belt with gold producer Regis Resources Limited, which has been successful in the identification of +8Moz of gold resources (refer to RRL’s website). The majority of these deposits reside on major well understood shear zones. GSN’s tenure in the Duketon Greenstone Belt includes significant portions of these shear zones and through the use of magnetic data and geological mapping, GSN immediately identified these shear zones as high priority target corridors, and have aggressively begun to explore these well understood trends. It is interpreted that all three mineralised corridors continue into the company’s tenure with:

- ~8km of the Erlistoun Trend

- ~7km of the Garden Well Trend

- ~11km of the Rosemont-Ben Hur Trend.

Southern Star

A total of 4,931m of Reverse Circulation drilling was completed in 2022 and builds on the total of over 11,000m which now has been drilled by GSN since acquiring the project in February 2021.

Drilling at Southern Star has reported exceptional gold grades of significant thicknesses. These results build on previous drill campaigns which have also have been highly successful including the following:

- 17m @ 7.0 g/t Au from 111m incl. 2m @ 56.7g/t Au in 21SSRC0039.

- 59m @ 2.1 g/t Au 9m @ 4.5 g/t Au and 16m @ 3.2 g/t Au from 53m in 21SSRC0009.

- 68m @ 1.9 g/t Au incl 4m @ 15.3 g/t Au and 5m @ 7.0 g/t Au from 61m in 21SSRC0036.

- 69m @ 1.1 g/t Au from 39m including a higher-grade core of 10m @ 3.5 g/t Au including 2m @ 12.0 g/t Au in 22SSRC0006.

- 46m @ 1.2 g/t Au 11m @ 3.4 g/t Au from 40m in 21SSRC00011.

- 7m @ 13.9 g/t Au 1m @ 91.7g/t Au from 123m in 21SSRC0017.

- 27m @ 1.5 g/t Au 6m @ 5.0 g/t Au from 77m in 21SSRC0015.

The recent drilling results reported focused on an area ineffectively explored, between two high grade zones. The outstanding intercepts noted now link the two zones of high-grade gold and enhance the zone of gold mineralisation already defined. These robust sections of gold mineralisation are expected to have a positive impact on the resource potential of the project, as mineralisation now joins together in a thick, continuous zone of over 600m.

The new drilling suggests a coherent panel of mineralisation with historic drillhole locations in this area being estimates only given their vintage.

Southern Star resides on the Rosemont-Ben Hur Trend and is only 4km south of Ben Hur. This prolific trend has produced well over 1.5Moz of resources for Regis Resources. The successful drill results at Southern Star to date, in combination with its position along strike from other significant deposits, has demonstrated a potential mineral resource development at Southern Star is emerging.

Golden Boulder

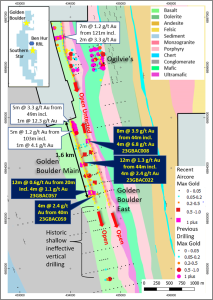

In May 2023 the Company announced the results of a recently completed Air Core (AC) program comprising 3,445m targeting two lines of mineralisation identified as the Golden Boulder Main and the Golden Boulder East trends. Both trends are delineated by historic gold workings which extend for over 3km. Golden Boulder is interpreted to sit along the greater Rosemont trend which hosts Regis Resources’ Rosemont (~1,06Moz Au) and Ben Hur (~390koz Au) deposits and GSN’s Southern Star prospect to the south.

Previous to GSN, drilling in the area was sparse, shallow and untargeted, averaging just 40m below surface.

Results indicate the potential to host economically significant gold mineralisation with both trends intersecting ore grade intercepts and continuous mineralisation over a considerable strike length. All significant intercepts from the recent AC drilling reside within the oxide zone.

Golden Boulder Main

Golden Boulder Main was identified as a high priority drill target when GSN first acquired the tenement (E38/3518) in 2020. Golden Boulder consists of over 50 shallow shafts with a reported historic production of 1,915 tonnes at 28.6 g/t Au for 1,761 ounces of gold (WAMEX report A85278). Chlorite altered sheared basalt with smokey quartz veins appears to host the highest grade gold.

Standout intersections from GSN’s first pass 16-hole drilling campaign in 2021 (Refer to GSN ASX announcement dated 23 September 2021) returned intercepts including:

- 5m @ 3.3 g/t Au from 49m, including 1m @ 12.3 g/t Au and 1m @ 1.2 g/t Au from 73m in 21GBRC0001, and

- 5m @ 1.2 g/t Au from 103m, including 1m @ 4.1 g/t Au in 21GBRC0007.

The 2023 AC drilling was designed to extend the mineralisation along strike to the south, with ~200m spaced lines perpendicular the interpreted mineralised trend. New intersections along the predicted line of mineralisation have increased the strike of Golden Boulder substantially with a 1.6km anomalous gold trend now defined. Significant intersections include:

- 12m @ 1.3 g/t Au from 44m, including 4m @ 2.4 g/t Au 48m in 23GBAC022,

- 12m @ 0.6 g/t Au from 20m, including 4m @ 1.0 g/t Au 24m in 23GBAC057, and

- 4m @ 2.4 g/t Au 44m in 23GBAC059.

Golden Boulder East

The Golden Boulder East target is defined by a small number of deep workings running parallel to Golden Boulder Main. Drilling targeted a ferruginous and strongly sheared quartz structure within a volcanic unit close to the contact of a ferruginous chert striking NNW-SSE.

This sedimentary chert package is believed to be acting as a trap for gold mineralisation and logging recorded a mixed package of shale and chert bands with gold hosted within the chert horizon.

The standout intercept on the Golden Boulder East trend of 8m @ 3.9 g/t Au from 44m, including 4m @ 6.8 g/t Au 48m in 23GBAC008, is within the chert horizon.